About Stratiq

Company Value Proposition

Stratiq Capital strives to be the general partner of choice for discerning investors who believe commercial real estate investments should be transparent, assets should have a clear defensive strategy, and the underlying assets should provide above-market risk-adjusted returns with less volatility.

Our Core Values

How We Operate

Speed

We value speed as the primary differentiator in our market.

Self-Discipline

We evaluate, identify, and employ only self-disciplined people.

Financial Responsibility

We control costs to aggressively grow revenue.

Exceptionalism

We promote a culture of excellence in every facet of life.

Creativity

We innovate continuously to improve both ourselves and creation.

Proactive Engagement

We measure, plan for, and maximize employee and client engagement.

Stratiq Capital Timeline

Our History

Analytical Property Forecasting

We began providing analytical property expense forecasting for the federal government.

GreenEfficient Predecessor Founded

The predecessor to GreenEfficient was founded with a fixed-fee repair and maintenance offering to green commercial buildings.

Private Purchases of Institutional Office

Stratiq’s general partners began acquiring mid-rise/high-rise office.

Predecessor (Spinout of GreenEfficient)

Predecessor business entered the commercial real estate business. Wholly-owned office assets surpassed 500,000 square feet.

Stratiq (Spinout of Predecessor)

Stratiq was formed by a group of 11 family offices and Predecessor to acquire commercial real estate and operating equity.

Stratiq Launches Strategic Fund, Syndication, & SMA

Capitalizing on 25-years of commercial property data, analytics and investing, Stratiq began offering its first investments externally.

Stratiq Capital Timeline

Our History

Analytical Property Forecasting

We began providing analytical property expense forecasting for the federal government.

1997GreenEfficient Predecessor Founded

The predecessor to GreenEfficient is founded with a fixed-fee repair and maintenance offering to green commercial buildings.

2000Private Purchases of Institutional Office

Stratiq’s general partners begin acquiring mid-rise/high-rise office.

2012Our business enters the commercial real estate business. Wholly-owned office assets now surpass 500,000 square feet.

2018Stratiq is formed by a group of 11 family offices and our operating business to acquire commercial real estate and operating equity.

2019Stratiq Launches Strategic Fund, Syndication, & SMA

Capitalizing on 25-years of commercial property data, analytics and investing, Stratiq begins offering its first investments externally.

2023

Our Focus

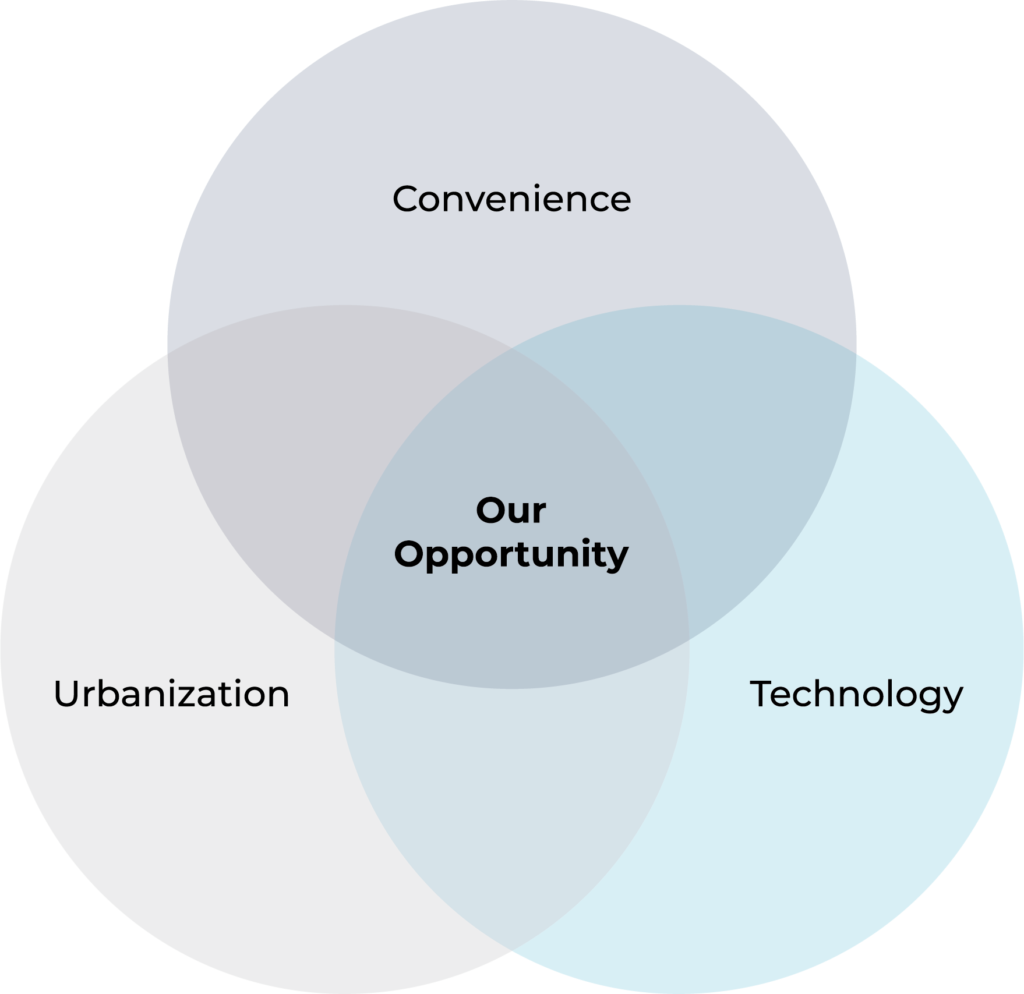

Opportunity

We use a defense-first strategy – targeting acquisitions with proximity to population density and wealth within the largest growing major Sun Belt cities. We’re led by a fully-aligned, hands-on partner and our tenant-centric operating partner.

Stratiq’s Impact

Making a Difference

We support organizations such as Blue Santa, National Christian Foundation, A Second Cup, and Incarnate Word Academy in order to make a meaningful impact on the communities we live and work in.

Stratiq has hired Measurabl to advise us through our ESG Framework and Policies while establishing permanent ESG goals.

Portfolio Level Value Creation

Timeline

2023 – 2025

Raise & place investor capital across identified strategies.

2025 – 2028

Optimization of portfolio debt, tenant-mix and cash flow from operations to investors.

2029 – 2031

Recapitalization of debt, distribution of capital to investors and long-term permanent financing.

7 Year IRR Optimization Period

Our model includes returning maximum investor capital via one or two recapitalizations during the 7-year target hold period. Major factors in timing are remaining lease terms for existing tenants, market cycles and debt terms.

Acquisitions Due Diligence

How We Operate

Acquisitions Project Team

Underwriting Due Diligence

Closing & Entity Information

Ownership Transition

Acquisitions Strategy and Process

Metrics & Analysis

Market Research & Analysis (Deal Flow)

Key Economic Indicators:

Property Metrics

Key Performance Indicators:

Preliminary LOI Gate Analysis

Key Terms and Consideration:

Contact Us

713-999-3517

23122 Valley Ranch Parkway

Houston, Texas 77365

2025 Guadalupe Street, Suite 260

Austin, Texas 78705

Quick Links

Copyrights © 2019-2022 All Rights Reserved by Stratiq Operations, LLC